Business reporter, BBC News

Getty Images

Getty ImagesA rise in the cost of household bills has pushed UK inflation to its highest rate in more than a year.

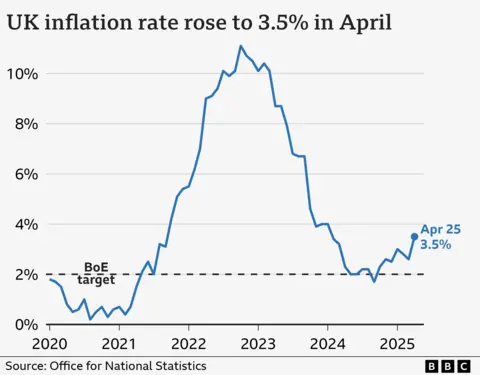

Inflation was 3.5% in April, up from 2.6% in March, according to official data.

Water, gas and electricity prices all went up on 1 April along with a host of other bills, pushing inflation further above the Bank of England’s target of 2%.

The largest upward contributors to the rise were from “housing and household services, transport, and recreation and culture,” the Office for National Statistics said.

April’s rate of inflation is higher than economists had predicted.

The pace of price rises was forecast to be around 3.3%.

The Bank of England has previously said it expects inflation to spike at 3.7% between July and September 2025 before dropping back to its 2% target.

In April, households were hit by sharp rises in energy and water bills, and – to a lesser extent – higher food prices. Firms were also hit by higher costs – a rise in employer National Insurance contributions and a higher minimum wage.

The ONS says prices of water and sewerage rose by 26.1% in April, which it said is the largest rise since at least February 1988.

It’s a combination of those factors that has driven inflation higher.

‘This is definitely the toughest it’s ever been’

James Cuthbertson says his brewery business will have to raise beer prices for the first time in two years because of his rising costs and wage bill.

“This is definitely the toughest it’s ever been, and there’s been some tough times, but certainly the rising costs have been crippling,” he says.

James is a partner at Lake Dan Brewing Company, which officially opened as a craft brewer in 2023 and now own a pub in Hawkhurst, Kent.

His says his main costs, water bills, yeast and hops have all increased between 5% and 10%. He says this has made it “difficult to be positive”.

“Everyone’s having to pass costs onto consumers that don’t have the money. So it doesn’t work if we’re getting crushed in the middle, and I think that’s the biggest challenge,” he says.

Grant Fitzner, acting director general of the ONS, said: “Significant increases in household bills caused inflation to climb steeply.

“Gas and electricity bills rose [in April] compared with sharp falls at the same time as last year due to changes to the Ofgem energy price cap.”

Chancellor Rachel Reeves said she was “disappointed” with the figures and cited April’s minimum wage rises and the decision to freeze fuel duty as helping pepole with the cost of living pressure.

Mel Stride, shadow chancellor, said the figure “is worrying for families”.

“We left Labour with inflation bang on target, but Labour’s economic mismanagement is pushing up the cost of living for families,” he added.

Paul Dales, chief UK economist at Capital Economics, said: “These figures will make the Bank more alert to the possibility that this rebound in inflation will be bigger and last longer than it had been thinking.”

The rise means the Bank of England governor – whose job is to keep inflation at its target of 2% – will have to write a letter to the chancellor.

One of the Bank’s key tasks is to keep inflation at 2% and it cuts or raises interest rates to achieve that.

They will need to explain why inflation has risen more than 1% over this and what the plan is to get the inflation rate back to 2%.